Moderators: richierich, ua900, PanAm_DC10, hOMSaR

Re: Tax reform win.

Tomorrow is Christmas for the downtrodden, and a most joyous Christmas to the tune of approxinately One trillion dollars for the Republican funders. Good for them, but I have to wonder about how good it will be for his redneck supporters. Ignorance is bliss as they say.

-

- MaverickM11

- Posts: 19258

- Joined:

Re: Tax reform win.

Quite impressed with Pence's voracious blowjob...I don't think Mother has to worry about other *women* in the room with her husband...

https://www.thedailybeast.com/my-theory ... -fulsomely

https://www.thedailybeast.com/my-theory ... -fulsomely

-

- einsteinboricua

- Posts: 8832

- Joined:

Re: Tax reform win.

Isn't it nice to know the true identity of the forgotten men and women?

Apparently they hang out at, and can afford the fees to be members of, Mar-A-Lago.

Oh how I hope a recording emerges of how Trump told his members how they all got a lot richer. It will make Romney's 47% gaffe seem like small change.

Apparently they hang out at, and can afford the fees to be members of, Mar-A-Lago.

Oh how I hope a recording emerges of how Trump told his members how they all got a lot richer. It will make Romney's 47% gaffe seem like small change.

Re: Tax reform win.

My bet for the biggest reason why Republican's may very well lose their tax reform bet is because they will have to respond to how the changes affect federal inflows. How companies and tax experts and states as well as the public react to and create new strategies that take advantage of the changes and maximize the tax savings/reduction. I very much believe the reduction to the treasury will be larger than even Republican's can accept and they will in turn have to makes change to address the tax intake (increase taxes). This happened with Reagan's cuts as well.

The market is very effective and I cannot see how what was passed could have been vetted so well as to prevent this from happening. We will have to wait and see of course. I just figured I would put this out there. You may flame away.

Tugg

The market is very effective and I cannot see how what was passed could have been vetted so well as to prevent this from happening. We will have to wait and see of course. I just figured I would put this out there. You may flame away.

Tugg

Re: Tax reform win.

In France president Macron having liberal (in the true sense of the world) tendencies, a reduction of several taxes is also being implemented. However this is done over the 5 years of his term, for example the corporate tax will go from 33.3% to 31% in 2019, 28% in 2020, 26,5% in 2021 and 25% in 2022. Other taxes are lowered while corresponding (modest) cuts are being made in spending.

Overall it should still "favor" the rich but some taxes were clearly hurting the economy, for example capital gains taxes at more than 50%, now lowered to 30%.

Overall it should still "favor" the rich but some taxes were clearly hurting the economy, for example capital gains taxes at more than 50%, now lowered to 30%.

Re: Tax reform win.

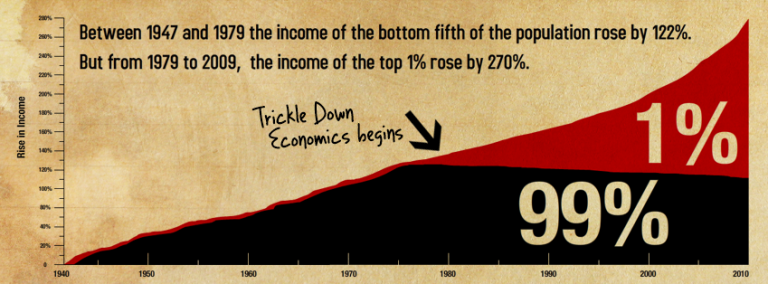

seb146 wrote:PPVRA wrote:Aesma wrote:Older generations that are more likely to be in the 1% :

Keynesian economics was a total disaster, which is why there was a huge political change that allowed for a change in economic thinking. Stagflation proved Keynes wrong. The entire planet has slowly realized and abandoned his ideas, though not completely yet. The third world still clings to it harder than anyone else.

It's absurd to suggest things were going great until 1979.

Really? Because, according to all graphs and reports we have ever seen, things were going great until Reagan took over. The rich were getting richer, the poor were getting richer and we all were doing pretty good until Reagan took over.

That's because that economy was based on consuming savings from current and previous generations, and even future ones through debt, which feels great--while it lasts.

Fixing all of this is painful and there's no escaping it. And Reagan didn't fix it all, either. There's still a lot to fix.

And BTW, it was JIMMY CARTER who deregulated the economy. What he did is far more important than the revenue-neutral tax reform Ronald Reagan did. That and the appointment of Paul Volcker to the Fed, which Reagan reappointed. Volcker is the man credit with turning the US economy around and kicking stagflation to the curb.

Re: Tax reform win.

Tugger wrote:My bet for the biggest reason why Republican's may very well lose their tax reform bet is because they will have to respond to how the changes affect federal inflows. How companies and tax experts and states as well as the public react to and create new strategies that take advantage of the changes and maximize the tax savings/reduction. I very much believe the reduction to the treasury will be larger than even Republican's can accept and they will in turn have to makes change to address the tax intake (increase taxes). This happened with Reagan's cuts as well.

The market is very effective and I cannot see how what was passed could have been vetted so well as to prevent this from happening. We will have to wait and see of course. I just figured I would put this out there. You may flame away.

Tugg

Unfortunately, spending cuts and or looking for ways to make Federal and Local Government spending more efficient will not be on the cards.

Re: Tax reform win.

Tugger wrote:My bet for the biggest reason why Republican's may very well lose their tax reform bet is because they will have to respond to how the changes affect federal inflows. How companies and tax experts and states as well as the public react to and create new strategies that take advantage of the changes and maximize the tax savings/reduction. I very much believe the reduction to the treasury will be larger than even Republican's can accept and they will in turn have to makes change to address the tax intake (increase taxes). This happened with Reagan's cuts as well.

The market is very effective and I cannot see how what was passed could have been vetted so well as to prevent this from happening. We will have to wait and see of course. I just figured I would put this out there. You may flame away.

Tugg

There is no doubt in my mind that the GOP games will fall short of their wet dreams. Deadbeat Don went on and on about ATT giving all employers $1,000. Now after a week of bragging ATT has announced that they are laying off 2,000 employees, including a lot of technical staff.

Ryan has also started on how Medicare and Medicaid will need to be cut off at the knees because of the loss of tax revenue. hopefully that will require 60 votes in the Senate so we can be protected until after the 2018 Election.

Americans moving off of the ACA or being pushed off of Medicaid are going to have major impacts on medical inflation. Employers are going to continue lowering the impact of these increases, dumping those cost increases on the employees.

The tax cuts for the rich are not going to benefit middle class America. That will be shown in the 2018 Election.

Re: Tax reform win.

Ken777 wrote:

Ryan has also started on how Medicare and Medicaid will need to be cut off at the knees because of the loss of tax revenue. hopefully that will require 60 votes in the Senate so we can be protected until after the 2018 Election.

Americans moving off of the ACA or being pushed off of Medicaid are going to have major impacts on medical inflation. Employers are going to continue lowering the impact of these increases, dumping those cost increases on the employees.

As I said in a previous post, we saw a 10% increase in company healthcare costs for 2018, our provider is estimating a 40% increase in 2019, we as a company will absorb part of that, but yes, all employees will feel it in 2019.

-

- einsteinboricua

- Posts: 8832

- Joined:

Re: Tax reform win.

jetwet1 wrote:As I said in a previous post, we saw a 10% increase in company healthcare costs for 2018, our provider is estimating a 40% increase in 2019, we as a company will absorb part of that, but yes, all employees will feel it in 2019.

I wonder how my company will fare if this comes to fruition. I currently have a HDHP at no cost to me (the company pays for it) PLUS half of my deductible deposited into an HSA every year. One of the reasons I avoided jumping ship earlier in the year was because the company I was looking into had a joke for health insurance: their HDHP was at $60/paycheck and any HSA deposits were on an after-tax basis. Imagine if the effects of the tax plan boost the price of the cheapest plan to double...Oh and when comparing my company's plans to this other company's, my company's most expensive plan comes to just a tad above the other company's cheapest. So yeah...

Re: Tax reform win.

Ken777 wrote:The tax cuts for the rich are not going to benefit middle class America. That will be shown in the 2018 Election.

I will raise the BS Flag here. I am a middle class american and I stand to get a nearly $2,000 tax break in fiscal year 2018. (Yes I have read the bill and done the math.) Most people I know are going to get this benefit as well.

As for Health Care. Congress keeps addressing the wrong issue. Both Parties have tried to address insurance, when in actuality the cost of insurance goes up regardless of who is in power and what the political parties have tried to do. Obamacare didn't fix the problem. And while what we had before Obama care worked better, people were paying too much before which is what prompted people to try to act on it, even though the solution was worse than the original problem. The issue is health costs have skyrocketed out of control. And one of the reasons people are forced to buy insurance is because the insurance companies use economies of scale to negotiate lower (but still way too high) prices, and people cannot get those lower prices on their own. Turning it over to government the way a lot of countries have done isn't going to work because then the lobbyists will see to it that taxpayers get price gouged on this, and then we have major issues.

I dont know how medical costs get addressed, but addressing insurance without addressing the actual medical costs really doesnt get anything done and is nothing more than lipstick on a pig.

Re: Tax reform win.

Ken777 wrote:

Ryan has also started on how Medicare and Medicaid will need to be cut off at the knees because of the loss of tax revenue. hopefully that will require 60 votes in the Senate so we can be protected until after the 2018 Election.

I doubt he will do anything to harm these entitlements. He made the stupid statement of putting seniors on vouchers and paid dearly. I would hope he learned his lesson.

Ken777 wrote:Americans moving off of the ACA or being pushed off of Medicaid are going to have major impacts on medical inflation. Employers are going to continue lowering the impact of these increases, dumping those cost increases on the employees.

So what is new about that? Ever since the ACA passed it's been a nightmare for people already with health coverage.

Ken777 wrote:The tax cuts for the rich are not going to benefit middle class America. That will be shown in the 2018 Election.

You keep saying for the rich but they weren't the only ones who got a tax cut. The rich hating class hate hasn't worked and was shown the door in the general election. I would wait to see how things go before you start handing the mid terms to the party who wants to raise taxes and put us in the box California is in.

-

- einsteinboricua

- Posts: 8832

- Joined:

Re: Tax reform win.

apodino wrote:Both Parties have tried to address insurance, when in actuality the cost of insurance goes up regardless of who is in power and what the political parties have tried to do. Obamacare didn't fix the problem.

I don't think anyone was under the impression that the ACA meant to immediately stop the cost of rising healthcare, especially after the mandate for the states was struck down. But I'll take a 3% increase over a 20% increase any day.

apodino wrote:And while what we had before Obama care worked better, people were paying too much before which is what prompted people to try to act on it, even though the solution was worse than the original problem.

Then it didn't work better, or it did for you but not for everyone, which is what the ACA was trying to fix.

apodino wrote:I dont know how medical costs get addressed, but addressing insurance without addressing the actual medical costs really doesnt get anything done and is nothing more than lipstick on a pig.

The government COULD address actual medical costs, but then the word "socialism" gets thrown around and efforts are abandoned.

An example: the epipen increases where in the span of 7 years the price had gone up over 400%. Another example: Shkreli and the Daraprim pill raised from $13.50 to $750 a pill. Any attempts to control market price are met with cries of socialism so of course this doesn't do much of anything. Alternative solution? Allow people to afford the medication by offering plans that can cover or significantly reduce the price.

Re: Tax reform win.

That’s because price controls (in anything) are an epically stupid idea with a ton of historical precedence to back up that it’s a bad idea. That’s not the way to control drug prices, while maintaining sustainable supply, research and innovation.

What’s needed in drug pricing is IP rights reform. There’s too much abuse and nonsense going on, and not just in drugs, either.

What’s needed in drug pricing is IP rights reform. There’s too much abuse and nonsense going on, and not just in drugs, either.

Re: Tax reform win.

PPVRA wrote:That’s because price controls (in anything) are an epically stupid idea with a ton of historical precedence to back up that it’s a bad idea. That’s not the way to control drug prices, while maintaining sustainable supply, research and innovation.

What’s needed in drug pricing is IP rights reform. There’s too much abuse and nonsense going on, and not just in drugs, either.

On this I basically fully agree. Patents are actually a drag on business and society. If granted they should be simpler and for a shorter period, say five to ten years. If you can't do something in that timeframe then you can sell, license, etc. and still be rewarded fro your success.

However I will note that "price controls" are not just governmental, industry does it all the time as well. So I would equally attack such fixing, collusion, and "controls" that industry does as well. For one example with pharmaceuticals, in the USA I would say we will not pay more for drugs than what is offered to any other country in the world (including discounts, etc.). The pharmaceutical company is then free to go from there.

Oh and another simple one that has been a pet peeve of mine for awhile now: Media (like movies etc.) and other such globally sourced and sold things. If you can sell a DVD or Blu-ray in one country for $1 then I should be allowed to buy it from that country and use it in my device here or anywhere. None of this "region specific" codes crap. You get to take advantage of making something in the lowest cost place worldwide, I get to also take advantage of the same and buy from the lowest cost.

Tugg

Re: Tax reform win.

PPVRA wrote:seb146 wrote:PPVRA wrote:

Keynesian economics was a total disaster, which is why there was a huge political change that allowed for a change in economic thinking. Stagflation proved Keynes wrong. The entire planet has slowly realized and abandoned his ideas, though not completely yet. The third world still clings to it harder than anyone else.

It's absurd to suggest things were going great until 1979.

Really? Because, according to all graphs and reports we have ever seen, things were going great until Reagan took over. The rich were getting richer, the poor were getting richer and we all were doing pretty good until Reagan took over.

That's because that economy was based on consuming savings from current and previous generations, and even future ones through debt, which feels great--while it lasts.

Fixing all of this is painful and there's no escaping it. And Reagan didn't fix it all, either. There's still a lot to fix.

And BTW, it was JIMMY CARTER who deregulated the economy. What he did is far more important than the revenue-neutral tax reform Ronald Reagan did. That and the appointment of Paul Volcker to the Fed, which Reagan reappointed. Volcker is the man credit with turning the US economy around and kicking stagflation to the curb.

Two things about your graph prove you wrong:

Trickle Down started after 1980, AFTER Reagan was elected.

The rich were getting richer BEFORE Trickle Down

Re: Tax reform win.

We won't stop price control (of drugs) to please you, so you will get French prices or lower, it will be backdoor price control.

Re: Tax reform win.

Okay, I just found something interesting, the ACA mandate was NOT removed via the new tax bill, the fine was set at $0, a slight difference.

What will be interesting is with the numbers of people leaving the ACA compliant programs, they are going to be left with low income/high risk people only, who by law receive the highest subsidies for the insurance....So I wonder who is going to pay for those subsidies.....Oh yeah, the tax payers.

What will be interesting is with the numbers of people leaving the ACA compliant programs, they are going to be left with low income/high risk people only, who by law receive the highest subsidies for the insurance....So I wonder who is going to pay for those subsidies.....Oh yeah, the tax payers.

-

- casinterest

- Posts: 16972

- Joined:

Re: Tax reform win.

You know those idiots in the Senate that voted to cut taxes, and didn't care about the revenue lost?

Well they found their calling on the spending bill.

https://www.politico.com/story/2018/02/ ... D=ref_fark

Intelligence is lost on the fiscal hawks.

Well they found their calling on the spending bill.

https://www.politico.com/story/2018/02/ ... D=ref_fark

Intelligence is lost on the fiscal hawks.

-

- casinterest

- Posts: 16972

- Joined:

Re: Tax reform win.

So Now that most of us have seen the new withholding in their paychecks, how are we feeling?

My family is on track for about 300 more a month n disposable income. How is everyone else doing? I expect the Pilots on this board are doing quite well.

Are the deficits worth it ?

Talking to some that have high property taxes, I understand their is some pain. How are those folks doing?

I was in NJ recently, and a lot of those folks were talking about moving south.

My family is on track for about 300 more a month n disposable income. How is everyone else doing? I expect the Pilots on this board are doing quite well.

Are the deficits worth it ?

Talking to some that have high property taxes, I understand their is some pain. How are those folks doing?

I was in NJ recently, and a lot of those folks were talking about moving south.

-

- einsteinboricua

- Posts: 8832

- Joined:

Re: Tax reform win.

My paycheck went up by $40. Not bad, but nothing groundbreaking either. I've tried using the IRS withholding calculator but I don't know if I'm using it correctly.

With regards to property taxes, I'm glad that my county's taxes (and my home value) keep me below the $10,000 maximum. My question is whether I'll be itemizing next year or taking the now-enlarged standard deduction.

With regards to property taxes, I'm glad that my county's taxes (and my home value) keep me below the $10,000 maximum. My question is whether I'll be itemizing next year or taking the now-enlarged standard deduction.

Re: Tax reform win.

Can't people/states sue the federal government over this by the way ? Basically Washington is picking winners and losers, while at the same time using the tax money taken to the losers to give it to the winners. Double whammy.

Re: Tax reform win.

Once the Congressional Budget Office runs the numbers and people find out that debt and deficit are out of control, I wonder what the excuse will be? How will Obama and Hillary be blamed?

I also wonder: now that people seem to think they have more money in their pockets, how long will it take for stores to jack up their prices so they can take that bump away from us?

I also wonder: now that people seem to think they have more money in their pockets, how long will it take for stores to jack up their prices so they can take that bump away from us?

-

- casinterest

- Posts: 16972

- Joined:

Re: Tax reform win.

seb146 wrote:Once the Congressional Budget Office runs the numbers and people find out that debt and deficit are out of control, I wonder what the excuse will be? How will Obama and Hillary be blamed?

I also wonder: now that people seem to think they have more money in their pockets, how long will it take for stores to jack up their prices so they can take that bump away from us?

The reports are starting . the Republican tax bill is stealing from working Americans to line the pockets of the rich.

https://www.marketwatch.com/story/us-fe ... 2018-03-12

"The numbers: The U.S. government recorded a monthly budget deficit of $215 billion in February, up 12% from the same month last year due to lower revenue and higher spending. For the first five months of the fiscal year, the government’s deficit is $391 billion, $40 billion more than the shortfall during the same period last year.

What happened: Revenues were down 9% in February from same month last year. Withholding taxes were 2% lower, the Treasury Department report said. Spending was $7 billion more than in the same period a year ago. Outlays for net interest on the public debt increased by 9% to $28 billion. The rise in spending was led by gains in military spending and for the aftermath of last years’ hurricanes."

-

- einsteinboricua

- Posts: 8832

- Joined:

Re: Tax reform win.

I'm sure that the responses will be:

1. Fake numbers (even though they ARE the government)

2. Yes, but Obama...

3. So what? Obama ran higher deficits.

4. It's all Obama's fault.

5. The deficit would be higher if Clinton had been elected

1. Fake numbers (even though they ARE the government)

2. Yes, but Obama...

3. So what? Obama ran higher deficits.

4. It's all Obama's fault.

5. The deficit would be higher if Clinton had been elected

-

- casinterest

- Posts: 16972

- Joined:

Re: Tax reform win.

einsteinboricua wrote:I'm sure that the responses will be:

1. Fake numbers (even though they ARE the government)

2. Yes, but Obama...

3. So what? Obama ran higher deficits.

4. It's all Obama's fault.

5. The deficit would be higher if Clinton had been elected

1. Deficits aren't fake, and the GOP owns them now

2. They can say but Obama all they want, but when the tax cuts cost more and more due to interest, maybe the will wake up

3. Obama didn't run higher defecits. The defecits were already set before he became President, by the congress and President at the time.

4. The GOP leadership can use this all they want. It is part of their racist plans to keep racists voting. There is a high correlation of sexism and racism in Trump's success, and the GOP leadership will continue to sell it.

5. As stated above, the GOP leadership will use Clinton as an answer because it feeds into the portion of their base that is energized by sexism and racism.

https://www.vox.com/identities/2017/1/4 ... nomy-study

Re: Tax reform win.

Aesma wrote:Can't people/states sue the federal government over this by the way ? Basically Washington is picking winners and losers, while at the same time using the tax money taken to the losers to give it to the winners. Double whammy.

That’s an interesting question. There’s certainly no precedent.

What’s more interesting is that Obamacare was held up by the Supreme Court because it was seen as a matter of tax policy. So, I doubt it.

Re: Tax reform win.

$600/month for us, making $300k+ together

No, it’s not worth it in the least.

No, it’s not worth it in the least.

-

- casinterest

- Posts: 16972

- Joined:

Re: Tax reform win.

Oklahoma is having the same issues with their taxes that Kansas did. They can't pay for the services they need in the state anymore after the lower taxes and breaks for oil and gas lowered available revenue.

http://kfor.com/2018/03/18/gop-confront ... -oklahoma/

http://kfor.com/2018/03/18/gop-confront ... -oklahoma/

-

- casinterest

- Posts: 16972

- Joined:

Re: Tax reform win.

All that growth the Tax Cuts are supposed to trigger has still not materialized. We now need to raise 300 billion this week through debt sales to fund the economy.

http://money.cnn.com/2018/03/27/investi ... index.html

For the record , this is the highest weekly sale since the recession of 2008. Also we usually depend on China to purchase the debt in large quantities. Hope we didn't piss them off with the Tariffs.

http://money.cnn.com/2018/03/27/investi ... index.html

For the record , this is the highest weekly sale since the recession of 2008. Also we usually depend on China to purchase the debt in large quantities. Hope we didn't piss them off with the Tariffs.

-

- einsteinboricua

- Posts: 8832

- Joined:

Re: Tax reform win.

The Hill also reported on how a majority of Americans are not feeling the benefit of the tax reform.

But with company bonuses over and now turning to stock buybacks and dividends, I wouldn't blame them.

But with company bonuses over and now turning to stock buybacks and dividends, I wouldn't blame them.

Re: Tax reform win.

casinterest wrote:All that growth the Tax Cuts are supposed to trigger has still not materialized. We now need to raise 300 billion this week through debt sales to fund the economy.

http://money.cnn.com/2018/03/27/investi ... index.html

Has it ever?

For the record , this is the highest weekly sale since the recession of 2008. Also we usually depend on China to purchase the debt in large quantities. Hope we didn't piss them off with the Tariffs.

Another screwing by the Republicans for the little people, I never expected anything different. I look at my savings portfolio and I do not see any improvement there either..Thank goodness I have a Pension Plan income.

-

- casinterest

- Posts: 16972

- Joined:

Re: Tax reform win.

WarRI1 wrote:casinterest wrote:All that growth the Tax Cuts are supposed to trigger has still not materialized. We now need to raise 300 billion this week through debt sales to fund the economy.

http://money.cnn.com/2018/03/27/investi ... index.html

Has it ever?

For the record , this is the highest weekly sale since the recession of 2008. Also we usually depend on China to purchase the debt in large quantities. Hope we didn't piss them off with the Tariffs.

Another screwing by the Republicans for the little people, I never expected anything different. I look at my savings portfolio and I do not see any improvement there either..Thank goodness I have a Pension Plan income.

And the Republican lies continue to get exposed.

https://www.washingtonpost.com/business ... 1032c3d273

"

The tax law that President Trump and congressional Republicans passed in December will cut government revenue by $1.3 trillion from 2018 to 2028, the CBO reported. When the costs of paying interest on that debt are included, the tax cuts’ total addition to the deficit comes to $1.9 trillion, the CBO said.

"

If the Republicans stay in power, it will be the poor and middle class paying back that deficit that was caused by giving the rich their tax break.

Re: Tax reform win.

casinterest wrote:And the Republican lies continue to get exposed.

https://www.washingtonpost.com/business ... 1032c3d273

"

The tax law that President Trump and congressional Republicans passed in December will cut government revenue by $1.3 trillion from 2018 to 2028, the CBO reported. When the costs of paying interest on that debt are included, the tax cuts’ total addition to the deficit comes to $1.9 trillion, the CBO said.

"

If the Republicans stay in power, it will be the poor and middle class paying back that deficit that was caused by giving the rich their tax break.

Doesn´t that mean the tax law is unlawful? https://www.budget.senate.gov/imo/media ... 20MARK.pdf

SEC. 2002. RECONCILIATION IN THE HOUSE OF REP18

RESENTATIVES.

(a) COMMITTEE ON WAYS AND MEANS.—The Com20

mittee on Ways and Means of the House of Representa21

tives shall submit changes in laws within its jurisdiction

that increase the deficit by not more than

$1,500,000,000,000 for the period of fiscal years 2018

through 2027.

1.9 Trillion seems to be a little more than the 1.5 trillion allowed ...

best regards

Thomas

-

- casinterest

- Posts: 16972

- Joined:

Re: Tax reform win.

tommy1808 wrote:casinterest wrote:And the Republican lies continue to get exposed.

https://www.washingtonpost.com/business ... 1032c3d273

"

The tax law that President Trump and congressional Republicans passed in December will cut government revenue by $1.3 trillion from 2018 to 2028, the CBO reported. When the costs of paying interest on that debt are included, the tax cuts’ total addition to the deficit comes to $1.9 trillion, the CBO said.

"

If the Republicans stay in power, it will be the poor and middle class paying back that deficit that was caused by giving the rich their tax break.

Doesn´t that mean the tax law is unlawful? https://www.budget.senate.gov/imo/media ... 20MARK.pdfSEC. 2002. RECONCILIATION IN THE HOUSE OF REP18

RESENTATIVES.

(a) COMMITTEE ON WAYS AND MEANS.—The Com20

mittee on Ways and Means of the House of Representa21

tives shall submit changes in laws within its jurisdiction

that increase the deficit by not more than

$1,500,000,000,000 for the period of fiscal years 2018

through 2027.

1.9 Trillion seems to be a little more than the 1.5 trillion allowed ...

best regards

Thomas

It's all ok, the GOP is going to pass a resolution on a Balanced Budget in the coming weeks to make good with their ignorant constituents. Just like a Glutton promising to eat like an Anorexic. .

Re: Tax reform win.

casinterest wrote:tommy1808 wrote:casinterest wrote:And the Republican lies continue to get exposed.

https://www.washingtonpost.com/business ... 1032c3d273

"

The tax law that President Trump and congressional Republicans passed in December will cut government revenue by $1.3 trillion from 2018 to 2028, the CBO reported. When the costs of paying interest on that debt are included, the tax cuts’ total addition to the deficit comes to $1.9 trillion, the CBO said.

"

If the Republicans stay in power, it will be the poor and middle class paying back that deficit that was caused by giving the rich their tax break.

Doesn´t that mean the tax law is unlawful? https://www.budget.senate.gov/imo/media ... 20MARK.pdfSEC. 2002. RECONCILIATION IN THE HOUSE OF REP18

RESENTATIVES.

(a) COMMITTEE ON WAYS AND MEANS.—The Com20

mittee on Ways and Means of the House of Representa21

tives shall submit changes in laws within its jurisdiction

that increase the deficit by not more than

$1,500,000,000,000 for the period of fiscal years 2018

through 2027.

1.9 Trillion seems to be a little more than the 1.5 trillion allowed ...

best regards

Thomas

It's all ok, the GOP is going to pass a resolution on a Balanced Budget in the coming weeks to make good with their ignorant constituents. Just like a Glutton promising to eat like an Anorexic. .

Well if I didn’t fear it before it’s quite clear there’s going to be another crash. I’ve been through 2, don’t want to go through a 3rd.

-

- casinterest

- Posts: 16972

- Joined:

Re: Tax reform win.

Why is the tax cut still so unpopular?

https://finance.yahoo.com/news/trump-ta ... 53692.html

From the article:

"Respondents are also concerned about the $1.8 trillion in new debt the US government will have to issue over the next decade, to make up for federal revenue lost to the tax cuts. “This was adding fuel to a fire already burning fine,” says Mike, a Wisconsin investment adviser. “We should be running, at worst, a break-even budget right now and stacking some dry powder. It was just a classic case of borrowing from the future at the stupidest possible time.” Mike is a Republican.

In our survey, 44.5% of respondents said short-term benefits from the tax cuts is not worth the additional debt. Only 39.4% feel the benefits are worth the additional debt."

https://finance.yahoo.com/news/trump-ta ... 53692.html

From the article:

"Respondents are also concerned about the $1.8 trillion in new debt the US government will have to issue over the next decade, to make up for federal revenue lost to the tax cuts. “This was adding fuel to a fire already burning fine,” says Mike, a Wisconsin investment adviser. “We should be running, at worst, a break-even budget right now and stacking some dry powder. It was just a classic case of borrowing from the future at the stupidest possible time.” Mike is a Republican.

In our survey, 44.5% of respondents said short-term benefits from the tax cuts is not worth the additional debt. Only 39.4% feel the benefits are worth the additional debt."

Re: Tax reform win.

casinterest wrote:Why is the tax cut still so unpopular?

https://finance.yahoo.com/news/trump-ta ... 53692.html

From the article:

"Respondents are also concerned about the $1.8 trillion in new debt the US government will have to issue over the next decade, to make up for federal revenue lost to the tax cuts. “This was adding fuel to a fire already burning fine,” says Mike, a Wisconsin investment adviser. “We should be running, at worst, a break-even budget right now and stacking some dry powder. It was just a classic case of borrowing from the future at the stupidest possible time.” Mike is a Republican.

In our survey, 44.5% of respondents said short-term benefits from the tax cuts is not worth the additional debt. Only 39.4% feel the benefits are worth the additional debt."

It is very clear and has been for quite a few years that the Republicans are not interested in paying their bills. They are irresponsible with the money needed for the USA.

While they love to point at the Dems for taxing too much at least that is trying to actually pay more bills. Of course the Dems then go on to commit to spending too much on their own priorities but the Republicans have been just as bad just spending on different priorities.

For me, while I am in the higher tax brackets, I want a modest tax increase combined with a relative freeze (or god forbid it were possible, a small reduction) in spending. I loved the automatic caps that went into place under Obama and that forced cuts to the budgets (and of course caused congress to come up with a lot of "off book" and creative spending ideas to circumvent the caps).

I say budget wisely and tax to pay your bills but NO ONE in interested in that, definitely not Republicans (and people can bluster all they want that Republican's are the "fiscally responsible party" but after the past years and the recent crap tax cut that is simply not true) and also not the Democrats.

Tugg

Re: Tax reform win.

Has anyone else noticed the price of things like gas and food has gone up in the past couple of weeks? Probably just a coincidence that our "tax break" and then some just went away....

-

- casinterest

- Posts: 16972

- Joined:

Re: Tax reform win.

seb146 wrote:Has anyone else noticed the price of things like gas and food has gone up in the past couple of weeks? Probably just a coincidence that our "tax break" and then some just went away....

Well,

If you saw the President's quote this morning, you can tell the oil prices are not making him happy, as it will really change the math on the tax cuts.

Tugger wrote:s very clear and has been for quite a few years that the Republicans are not interested in paying their bills. They are irresponsible with the money needed for the USA.

While they love to point at the Dems for taxing too much at least that is trying to actually pay more bills. Of course the Dems then go on to commit to spending too much on their own priorities but the Republicans have been just as bad just spending on different priorities.

Politicians all have the same problem, they spend more than they can bring in. The GOP just has a serious crisis in that they lie about how they will bridge the gap to their base, and their base believes them .

They are like Jack and the "Magic Beans".

Tugger wrote:I say budget wisely and tax to pay your bills but NO ONE in interested in that, definitely not Republicans (and people can bluster all they want that Republican's are the "fiscally responsible party" but after the past years and the recent crap tax cut that is simply not true) and also not the Democrats.

Everyone is interested in it, but when trying to wind an election, each side thinks they can depend on "magical growth" down the line.

Re: Tax reform win.

Even more winning from the party of fiscal responsibility

https://www.vanityfair.com/news/2018/02 ... e-treasury

The debt cieling will have to be raised again because the government is running out of money faster than Republicans thought. So much winning....

https://www.vanityfair.com/news/2018/02 ... e-treasury

The debt cieling will have to be raised again because the government is running out of money faster than Republicans thought. So much winning....

-

- casinterest

- Posts: 16972

- Joined:

Re: Tax reform win.

seb146 wrote:Even more winning from the party of fiscal responsibility

https://www.vanityfair.com/news/2018/02 ... e-treasury

The debt cieling will have to be raised again because the government is running out of money faster than Republicans thought. So much winning....

They don't have to worry. They pushed it out till after the election. The party is blacked out and still on a bender.

https://www.thebalance.com/u-s-debt-cei ... es-3305868

"

Current Status

On February 9, 2018, President Trump signed a bill suspending the debt ceiling until March 1, 2019. As a result, the limit will be whatever level the debt is on that day. The Committee for a Responsible Federal Budget estimated that the debt will increase to $22 trillion by March 2019. Shortly after Trump suspended the ceiling, the debt exceeded $21 trillion on March 15, 2018.

"

Re: Tax reform win.

casinterest wrote:seb146 wrote:Even more winning from the party of fiscal responsibility

https://www.vanityfair.com/news/2018/02 ... e-treasury

The debt cieling will have to be raised again because the government is running out of money faster than Republicans thought. So much winning....

They don't have to worry. They pushed it out till after the election. The party is blacked out and still on a bender.

https://www.thebalance.com/u-s-debt-cei ... es-3305868

"

Current Status

On February 9, 2018, President Trump signed a bill suspending the debt ceiling until March 1, 2019. As a result, the limit will be whatever level the debt is on that day. The Committee for a Responsible Federal Budget estimated that the debt will increase to $22 trillion by March 2019. Shortly after Trump suspended the ceiling, the debt exceeded $21 trillion on March 15, 2018.

"

And we all know Fox "news" and right wing media and all of the tRump supporters will blame "liberals" for the current state of the debt and deficit. When anyone tries to educate them, they will simply put their fingers in their ears and scream "YOU ARE A LYING LIBERAL!!!"

Re: Tax reform win.

This is really a circus. Going bonkers every couple of years over the debt ceiling, causing shutdowns etc., then just "suspending" it like that ?

How can US citizens elect most of these politicians when they don't do anything they promise, most of the time they don't even try ? How many congressmen are officially against abortion, and will campaign over it every two years, then nothing happens ? The gun situation ? And of course campaign finances and funding, lobbies controlling what matters... It's really incomprehensible how there are still people bothering to vote.

2nd amendment people, when are you planning to take back your country ? What are you waiting for ?

How can US citizens elect most of these politicians when they don't do anything they promise, most of the time they don't even try ? How many congressmen are officially against abortion, and will campaign over it every two years, then nothing happens ? The gun situation ? And of course campaign finances and funding, lobbies controlling what matters... It's really incomprehensible how there are still people bothering to vote.

2nd amendment people, when are you planning to take back your country ? What are you waiting for ?

Re: Tax reform win.

Tugger wrote:It is very clear and has been for quite a few years that the Republicans are not interested in paying their bills. They are irresponsible with the money needed for the USA.

And piling on debt unnecessarily is a good way to take future democrat governments ability away from being effective.

Aesma wrote:How can US citizens elect most of these politicians when they don't do anything they promise, most of the time they don't even try ?

There is one promise they tend to keep "I am bringing more money back into this district as we pay in taxes!". Almost everybody is using it, and that promise is mutely exclusive with a balanced budget.

Well, that is 2004, does anyone have that with current numbers? And is it just me or does it seem that Republican led state are especially good in paying less than what they spend?

best regards

Thomas

Re: Tax reform win.

Six big banks saved $3.5 BILLION in taxes. But there is no money for affordable health care, affordable education, clean water in Flint, clean water in Appalachia, power and water in Puerto Rico, public transportation, good paying jobs

https://www.cnbc.com/2018/04/20/big-ban ... w-law.html

Stop the winning.....

https://www.cnbc.com/2018/04/20/big-ban ... w-law.html

Stop the winning.....

Re: Tax reform win.

The simple fact is Trump lied. I am not surprised but it is one more thing that makes him a disappointing president.

Tugg

Tugg

-

- casinterest

- Posts: 16972

- Joined:

Re: Tax reform win.

And another lie is exposed.

The CBO has found that this tax reform will incentivize offshoring, and will help keep workers wages down.

http://prospect.org/article/even-cbo-sa ... offshoring

"

Two weeks ago, the CBO published its report on the next decade’s outlook for the budget and the economy, which included an analysis of the tax reform. Buried in the 162-page report was a paragraph about the effects of tax provisions on corporations’ location of tangible assets, like investments and jobs. As the report reads:

By locating more tangible assets abroad, a corporation is able to reduce the amount of foreign income that is categorized as GILTI [global intangible low-tax income]. Similarly, by locating fewer tangible assets in the United States, a corporation can increase the amount of U.S. income that can be deducted as FDII [foreign-derived intangible income]. Together, the provisions may increase corporations’ incentive to locate tangible assets abroad [emphasis added].

"

The CBO has found that this tax reform will incentivize offshoring, and will help keep workers wages down.

http://prospect.org/article/even-cbo-sa ... offshoring

"

Two weeks ago, the CBO published its report on the next decade’s outlook for the budget and the economy, which included an analysis of the tax reform. Buried in the 162-page report was a paragraph about the effects of tax provisions on corporations’ location of tangible assets, like investments and jobs. As the report reads:

By locating more tangible assets abroad, a corporation is able to reduce the amount of foreign income that is categorized as GILTI [global intangible low-tax income]. Similarly, by locating fewer tangible assets in the United States, a corporation can increase the amount of U.S. income that can be deducted as FDII [foreign-derived intangible income]. Together, the provisions may increase corporations’ incentive to locate tangible assets abroad [emphasis added].

"

Re: Tax reform win.

https://www.yahoo.com/finance/news/3-bi ... 57455.html

Check the table, get ready to get screwed. What is the name of this Thread? Tax reform win????????

Check the table, get ready to get screwed. What is the name of this Thread? Tax reform win????????

-

- casinterest

- Posts: 16972

- Joined:

Re: Tax reform win.

Yet more bad news from the Tax Reform.

Tom Price has reversed his position and declared that the repeal of the individual mandate will cost people more money for insurance

"http://www.businessinsider.com/tom-price-obamacare-mandate-repeal-trump-gop-tax-bill-2018-5"

It's amazing how folks that are finally released from the Trump Mind warp find some intelligence in the real world.

Tom Price has reversed his position and declared that the repeal of the individual mandate will cost people more money for insurance

"http://www.businessinsider.com/tom-price-obamacare-mandate-repeal-trump-gop-tax-bill-2018-5"

It's amazing how folks that are finally released from the Trump Mind warp find some intelligence in the real world.

Who is online

Users browsing this forum: No registered users and 54 guests